will capital gains tax increase be retroactive

9 and racing against a Sept. Specifically the Greenbook proposes to tax long-term capital gains and qualified dividends of taxpayers with adjusted gross income of more than 1 million at ordinary.

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

This potential retroactive tax can impact four categories of high-income clients.

. Also notable that since it would be retroactive to April 28 2021 it could influence many folks who took gains during the latest crypto surge. The proposed tax increase on capital gains may be applied to taxpayers with annualized realized gains over 1 million with those. By then what is legally permissible retroactively changing the capital gains rules becomes far less politically feasible as retroactive tax hikes tend to be viewed in an especially harsh light.

September 28 2021. Democrats have made an increase in the capital gains rate a major priority in their upcoming reconciliation tax bill and the potential effective date is critical for many investment decisions. This would be a very unpleasant surprise to households that may have wanted a chance to lock in some gains before any higher tax rates went into effect.

27 deadline there could be imminent action triggering an effective. The 2022 Greenbook indicates that the proposed capital gains tax increase as part of the American Families Plan would be retroactive to late April 2021 the date of the Plans announcement. Another would raise the capital gains tax rate to 396 for taxpayers earning 1 million or more.

If not retroactively then likely by January 1 2022. Hike to the capital gains inclusion rate may occur in the next federal budget. The proposed capital gains rate hike may be retroactive to the date of announcement the.

Given that Bidens capital-gains tax proposals face headwinds already we think it is unlikely that. The clients capital gains would be taxed at their ordinary income marginal tax rate which is 37 for 2021 but would rise to 396 in 2022 under the Biden budget plus the 38 Medicare surtax. Private Equity Faces Increase In Capital Gains Tax Rate Our Insights Plante Moran 2 Capital Gains Tax Hike Would Imperil Active Mutual Funds Bloomberg Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others Higher Capital Gains Taxes Daily Market Update Lpl.

Still another would make the change. Bidens pre-election proposal advocated almost doubling the top tax rate on capital gains from the current 20 or 238 including the. Perhaps the most newsworthy item in the Treasury Department Greenbook was the Biden Administrations proposal to increase taxes on capital gains on a retroactive basis.

Most recent significant tax law legislation. With tax writers launching mark-ups as early as Sept. Whats clear is that a capital gains tax hike is almost certainly on its way.

Accordingly there is nothing stopping Congress from passing the Biden tax plan and making the proposed 396 top capital gains rate retroactive to some point earlier this year. If you would like to plan for a potential increase in the inclusion. Top earners may pay up to 434 on long-term capital gains including the 38 Obamacare surcharge.

If a change to the capital gain inclusion rate is announced in the upcoming budget it is not known whether it would be effective immediately be retroactive or start at a future date. Thus the capital gains tax excluding the surtax for 2020 would be 800000 20 times 4 million. Bidens capital-gains tax plan may be retroactive worrying top bank CEOs Biden called for nearly doubling the capital-gains tax rate to 396.

Some analysts predicted any rise in capital-gains taxes will not end up being retroactive. As we enter into a new era of tax code proposals from the Biden administration its important to be thinking about what those changes may mean when planning for the upcoming tax season and retirement. Our Team is monitoring new developments as some of the tax proposals in the Greenbook are unclear.

With everything else uncertain those who have had or could potentially gain even marginally above that threshold in 2021including. Dramatically changing tax policy to increase taxes - nobody tends to mind much when you lower their taxes more than halfway through the year when many individuals have. One idea in play is a retroactive capital gains tax increase raising the top tax rate currently 238 percent imposed on the gain from the sale of assets held longer than a year9 President Bidens budget proposal suggested raising the rate on such capital gains to 434 percent for households with income over 1 million effective for all sales on or.

As MarketWatch points out the change primarily affects those households with income of 1 million or more. However this recent experience does not foreclose the possibility that a capital gain rate increase could be implemented on a retroactive basis.

Good And Bad News From The Aba Futures Report Perspective Decade Century Aba Bad News

Wall Street Panicking That Biden S Tax Hikes Will Be Retroactive

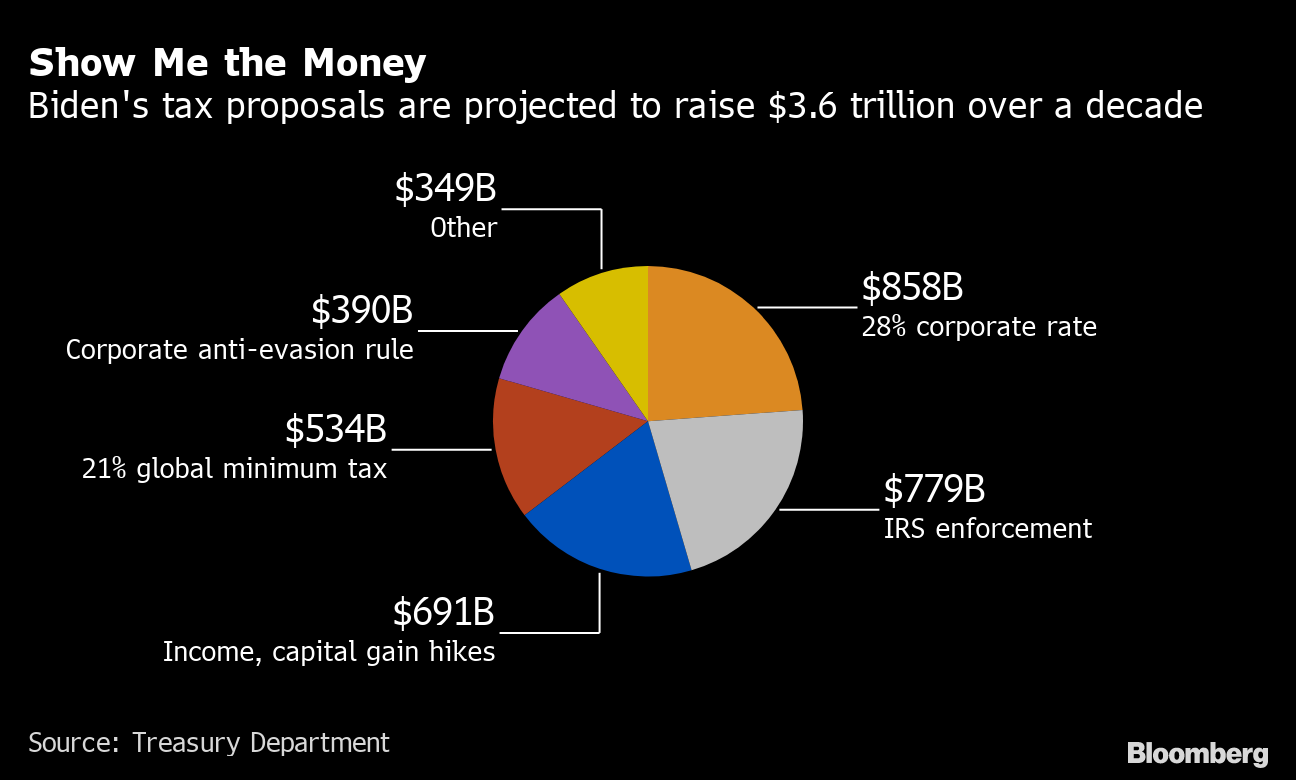

Biden Tax Plan Is Forecast To Bring In 3 6 Trillion Over Decade

The Eitc Finder App Will Show You How Much Tax Credit You May Be Able To Claim App Tax Credits Nintendo Wii Logo

R Rated Top Android App By Best Android App Review Bloomberg Bna S Handy Quick Tax Reference Guide Gives You Access T Medicaid Corporate Law Marketing Jobs

Sometimes It Can Be Tempting To Escape Into The Rage Quitting Daydream When Work Is A Nightmare But Instead Of Esca In 2021 How Are You Feeling Rage Quit Quitting Job

Tax Increases Are Coming Or Are They Bny Mellon Wealth Management

.png)

Biden S Green Book Includes Retroactive Capital Gains Tax Increase Husch Blackwell Llp Jdsupra

Retroactive Effective Date For Capital Gains Tax Increase Is A Bad Idea

Proposed Impactful Tax Law Changes And What You Can Do Now Johnson Pope Bokor Ruppel Burns Llp

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

How To Help Your Real Estate Investor Clients Structure Their Businesses Accounting Today In 2021 Real Estate Investor Real Estate Investors

Managing Tax Rate Uncertainty Russell Investments

Will Section 529a Plans Replace Special Needs Trusts Financial Advisory Financial Advisors Social Security Benefits

Understanding The Proposed Retroactive Capital Gains Tax Rate Increase Frazier Deeter Llc

A Closer Look At 2021 Proposed Tax Changes Charlotte Business Journal

Are You Ready To Talk Tax Join Us Live 3pm Az At The Tax Goddess Facebook Page For Our Live Q A Session With Shauna The Tax Goddes Tax Questions Cpa Business

Private Equity Faces Increase In Capital Gains Tax Rate Our Insights Plante Moran

What Can The Wealthy Do About Biden S Proposed Tax Increases