when will capital gains tax increase uk

The UKs Capital Gains Tax take was up 42 to 143 billion in 2020-21 from 101 billion in 2019-20. Note that short-term capital gains taxes are even higher.

How Capital Gains Tax Works In Canada Forbes Advisor Canada

Implications for business owners.

. Many speculate that he will increase the rates of capital. Capital Gains Tax rates in the UK for 202223. The rates for higher rate taxpayers are 20 and 28 respectively.

In tax year 2021 the lifetime gift tax exclusion was estimated to be 117 million for individuals and 234 million for. Simply put capital gains tax CGT is paid when an asset other than your main residence is sold at a profit. Your overall earnings determine how much of your capital gains are taxed at 10 or 20.

Ive read that in the budget a CGT increase is likely to happen. With the tax free allowance of 12K being reduced to somewhere around 3K and the tax rate to be increase from 20 to. Calculate Capital Gains Tax on property If you have Capital Gains Tax to pay You must report and pay any Capital Gains Tax on most sales of UK property within 60 days.

Dividend tax rates to increase. Find out moreNational Insurances rates. Job in Liverpool - England - UK L21 0.

Some 323000 taxpayers footed the CGT bill in 2020-21 an increase. Proposed changes to Capital Gains Tax. Salary 32000 GBP Yearly.

Any amount above the basic tax rate will hit the 20 charge on assets and 28 for residential property. Currently there are four rates of CGT being 18 and 28 on UK. This could result in a significant increase in CGT rates if this recommendation is implemented.

Individuals have a personal allowance of 12300 a year meaning that no capital gains tax is payable on. 2 days agoHMRC had issued closure notices for additional capital gains tax applying section 809L to the settlement of the indemnities. By Charlie Bradley 0700 Thu Oct 28.

Starting in 2022 the maximum will be raised to 16000. Technical Specialist - Capital Gains Tax. The capital gains tax-free allowance for the 2021-22 tax year is 12300.

The changes in tax rates could be as follows. Capital Gains Tax is a tax on the profit when you sell or dispose of something an asset thats increased in value. But the tax rate that will apply to your long-term capital gains does depend on what your taxable income rate is.

Class 3 1585 per week. In your case where capital gains. The Chancellor will announce the next Budget on 3 March 2021.

Our capital gains tax rates guide explains this in more detail. 10 18 for residential property for your entire capital gain if your overall annual income is below 50270. Its the gain you make thats taxed not the.

Similarly to the National. Section 809L sets out the meaning of remitted to. The changes were criticised by a number of groups including the Federation of Small Businesses who claimed that the new rules would increase the CGT liability of small businesses and.

CAPITAL GAINS TAX will increase in the next couple of years to a 28 percent rate according to Nimesh Shah of Blick Rothenberg.

Biden Administration May Spell Changes To Estate Tax And Stepped Up Basis Rule

Residential Property Capital Gains Tax Michelmores

The Tax Impact Of The Long Term Capital Gains Bump Zone

Crypto Tax Uk Ultimate Guide 2022 Koinly

Explainer Capital Gains Tax Hike Targets Wealthy Investors Explainer Tesla Republicans Congress Wall Street The Independent

Hmrc Tax Rates And Allowances For 2022 23 Simmons Simmons

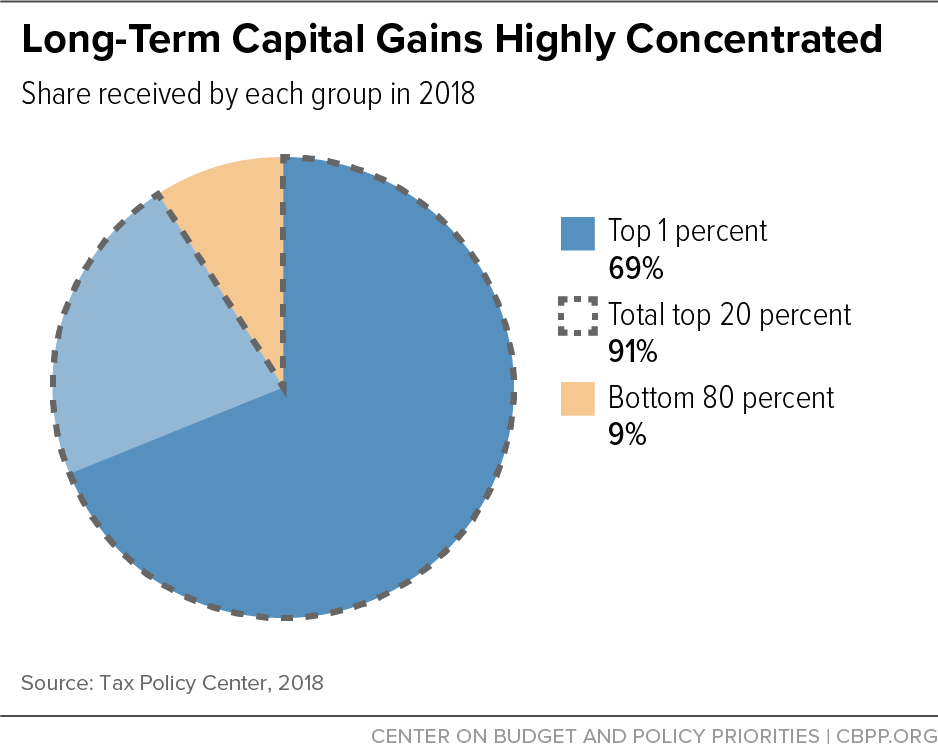

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

How Are Dividends Taxed 2022 Dividend Tax Rates The Motley Fool

2021 2022 Long Term Capital Gains Tax Rates Bankrate

How Does The Capital Gains Tax Work Now And What Are Some Proposed Reforms

Times Faceoff Both Us And Uk Are Planning To Hike Capital Gains Tax Should We Use Revenue To Cut Steep Duties On Fuel Times Of India

Capital Gains Tax When Selling A Home Homeowners Alliance

Biden Capital Gains Tax Rate Would Be Highest In Oecd

Rishi Sunak Shelves Proposal To Hike Capital Gains Tax Pointing To Burden The Independent

Capital Gains Tax Low Incomes Tax Reform Group

Post Covid 19 Tax Planning Be Prepared For Tax Rises Cgwm Uk

How Much Is Capital Gains Tax Cgt Rates Explained And Budget Proposal Nationalworld

How Will Uk Landlords Be Affected By A Capital Gains Tax Increase Business Leader News